Comparing blockchains: Bitcoin vs. Ethereum

How to prepare for an Initial Exchange Offering

April 17, 2019

The top 10 crypto hedge funds

April 26, 2019Comparing blockchains: Bitcoin vs. Ethereum

Bitcoin and Ethereum have battled for top spot in the cryptocurrency rankings for what seems like an eternity. By price and market cap they are number one and two, with a country mile between second-place Ethereum and the nearest competitor Ripple. Sometimes it seems like everyone else is competing for third.

With the struggle between Bitcoin’s dominance and Ethereum’s challenger status set to continue for the foreseeable future, it’s worth taking a closer look at what distinguishes one from the other.

Bitcoin and Ethereum are very different, with distinct use cases, technical structures, developer communities, and ambitions.

Bitcoin Vs Ethereum

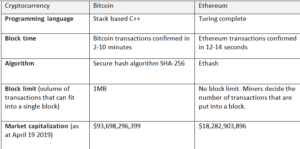

While Bitcoin and Ethereum are both driven by blockchain technology and its principles of cryptography and distributed ledgers, in many ways the similarity ends there. The programming language used by Ethereum is Turing complete.

Bitcoin on the other-hand is written in stack-based language C++. Other distinctions include the time to confirm transactions. Ethereum confirms them in seconds – most of the time – while Bitcoin can take minutes.

Their fundamental builds are also distinct. Bitcoin uses a secure hash algorithm called SHA-256 while Ethereum uses Ethash.

At their core however, Bitcoin and Ethereum differ in purpose. While Bitcoin was one of the first established cryptocurrencies, created as an alternative to fiat currencies and bank controlled payment systems, Ethereum was created to be a platform for new applications – with a native cryptocurrency called Ether attached.

Though Bitcoin and Ether are both cryptocurrencies, Ether’s main purpose isn’t to create a new form of alternative payment. It exists to enable and monetize Ethereum’s operation, while supporting developers as they build new blockchain applications (called DApps).

It also enables the use of peer-to-peer smart contracts, which allow the counterparties in any Ethereum transaction to confirm their exchange without the involvement of third parties – no matter how complex the transaction.

To that end Ethereum has launched a high-powered industry partnership called the Enterprise Ethereum Alliance (EEA), which brings together start-ups and major corporates to find new commercial use cases for Ethereum’s blockchain technology.

Point by point:

Bitcoin remains the biggest coin (by far) while Ethereum works hard to be the most innovative and open. Beyond that let’s compare key structural and financial differences:

For their end users, Bitcoin and Ethereum also have very different practical applications.

Some people buy Bitcoin because they don’t want an alternative to storing money in a bank. Others see it as an investment, wagering that its price will trade up in the coming months or years and be higher than it is today. For some, purchasing Bitcoin is a way to invest in companies that raise money through an initial coin offering or ICO, since equity in those companies can’t be bought with fiat currency.

Ethereum can support those uses as well, but Ethereum is much more than a currency. It’s a platform for new applications, innovations, smart contracts and an expanding developer community. As one often quoted blogger has so succinctly put it: ‘Bitcoin aims to disrupt currency. Ethereum wants to disrupt equity.’